To start with, why should you keep your money at D.L. Evans Bank?

We believe that our historic stability speaks volumes about who we are as a company and what our values are based on. D.L. Evans Bank was chartered in 1904, over 118 years ago. We are safe, secure, and sound. As a community bank, D.L. Evans Bank remains well capitalized and well positioned to continue to serve our customers and communities.

How is D.L. Evans Bank different from other financial institutions out there?

D.L. Evans Bank is a privately held, family-owned and employee-owned community bank. By banking with D.L. Evans Bank, you are making the decision to bank with a locally owned business. We expect to serve our communities in Idaho and Utah for generations to come. After all, we live in your community too, and your success is our success. As our customer, you have access to our experienced team, and we stand ready to always assist you with any of your questions or concerns. As a community bank, we take pride in our relationship-based business model focused on building long-term trust with our customers.

How is D.L. Evans Bank keeping my money safe?

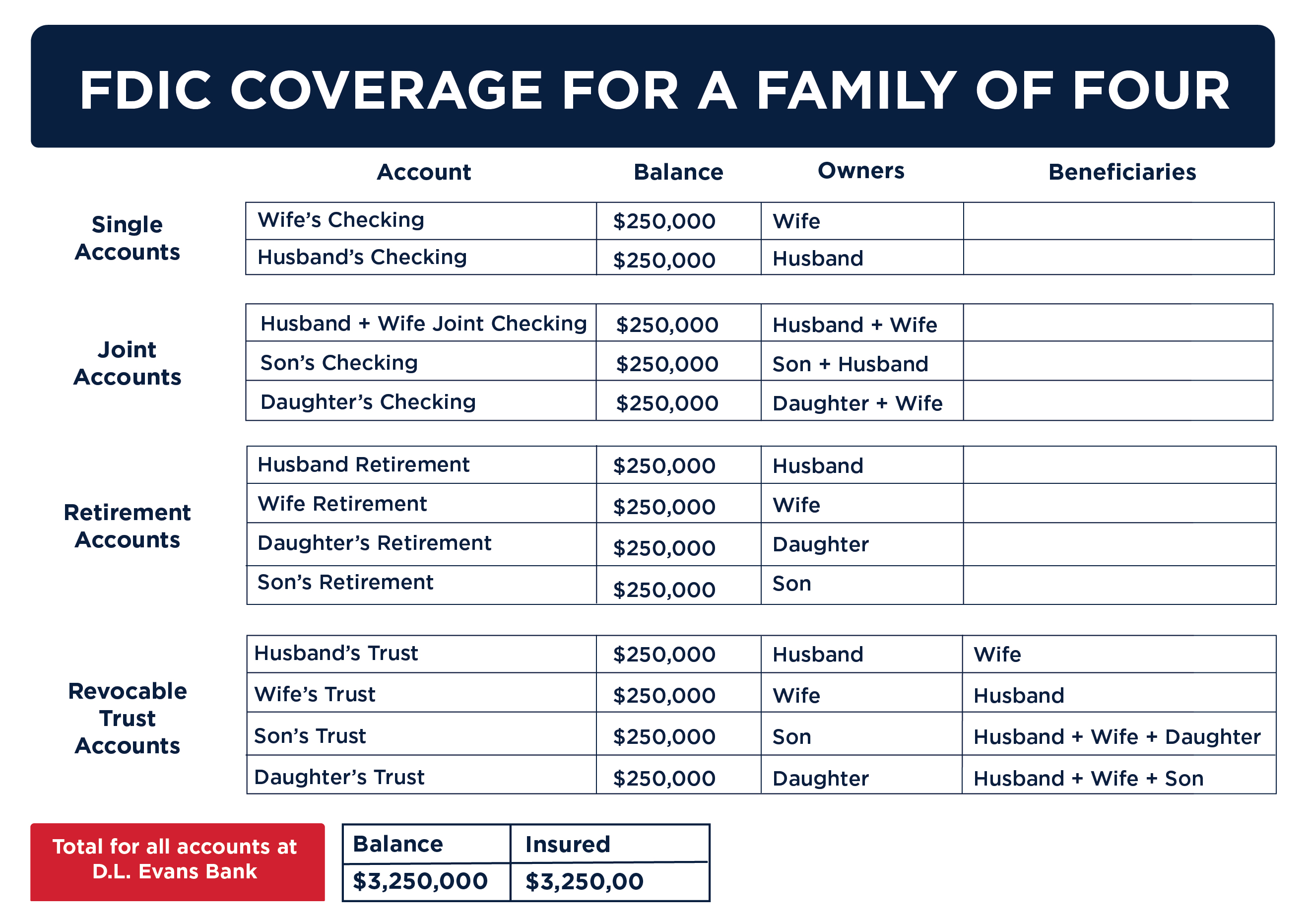

Our asset quality is impeccable, and we are well positioned to continue to serve our customers and communities. D. L. Evans Bank is federally insured by the Federal Deposit Insurance Corporation (FDIC) in the amount of $250,000 per customer, per ownership category. The FDIC is an independent agency of the United States government that protects you against the loss of your deposits. FDIC insurance is backed by the full faith and credit of the United States government and since the FDIC's creation in 1933, no depositor has ever lost one penny of FDIC-insured deposits.

Can I have more than $250,000 insured by the FDIC and how can I maximize my coverage?

Yes! Below is an illustration and an example of what coverage might look like when accounts are strategically structured following the per customer per ownership model. The most common account ownership categories for individual and family deposits are single accounts, joint accounts, revocable trust accounts, and certain retirement accounts.

How can I as a D.L. Evans Bank customer determine if my money is fully insured at D.L. Evans Bank?

We welcome you to always contact us and we will discuss your specific account structure with you. Additionally, the FDIC offers an Electronic Deposit Insurance Estimator (EDIE) which will calculate the FDIC insurance coverage based off the type of account, account ownership, and beneficiary information.

FDIC: Electronic Deposit Insurance Estimator (EDIE)

What if I require more coverage than what FDIC offers?

Institutions like ours that offer CDARS and ICS are members of a special network. When we place your deposit through the CDARS or ICS service, that deposit is divided into amounts under the standard FDIC insurance maximum of $250,000. The amounts are then placed in CD’s (using CDARS) or money market deposit accounts (using ICS) at multiple banks. As a result, you can access coverage from many institutions while working directly with just one. You receive one monthly statement from our bank for each service in which you participate. As always, your confidential information is protected.

FDIC's Electronic Deposit Insurance Estimator (EDIE)

EDIE lets consumers know, on a per-bank basis, how the insurance rules and limits apply to a depositor’s specific group of deposit accounts, what’s insured, and what portion (if any) exceeds coverage limits at the bank. EDIE also allows the user to print the report for their records.

FDIC's Electronic Deposit Insurance Estimator (EDIE)

Watch a short video explaining how it all works.

Need to Contact the FDIC?

Send your questions by email using the FDIC's online Customer Assistance Form.

Telephone:

Call toll-free: 1-877-ASK-FDIC (1-877-275-3342)

Monday - Friday 8 a.m. - 8 p.m. (Eastern Time)

Hearing Impaired: 1-800-925-4618.