A you-centered approach to investing.

We are equipped and ready to help you and the investment products and services that are right for you. Your financial goals are our priority, and with the innovative solutions and fiduciary relationships we offer, you can have confidence that we will consistently guide you with your best interest in mind. Collaborating with one of our local advisors means you will receive specialized support, offering timely, transparent, and personalized advice to simplify the complex.

Our advisors prioritize treating you as an individual, not just an account, and are committed to cultivating a long-term relationship with you. We understand that investment products are tools to help you and your family prepare for the future, and we will always keep your goals at the forefront when identifying suitable investment options. Our team is dedicated to personalizing, educating, and simplifying the investment process for your benefit.

Investment Services Include:

- Mitigating risk with our Risk Tolerance tool

- Creating a legacy for your family

- Identifying new financial opportunities

- Receiving straightforward and individualized advice

- Utilizing professionally managed accounts

- Consolidating and creating a lifetime income strategy

- Protecting your family with insurance solutions

- Working with Fiduciary Financial Advisors

Securities and Insurance products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFG STC Insurance Agency LLC), member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with the financial institution where investment services are offered. Investment Adviser Representatives only offer advisory services. D.L. Evans Investment Services is a marketing name for Cetera Investment Services. Investments are:

- Not FDIC/NCUSIF insured

- May lose value

- Not financial institution guaranteed

- Not a deposit

- Not insured by any federal government agency

Click here to view Cetera Investment Services Important Information and Business Continuity Plan.

Check the background of this investment professional on FINRA's BrokerCheck.

This site is published for residents of the United States only. Registered Representatives of Cetera Investment Services LLC may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Not all of the products and services referenced on this site may be available in every state and through every advisor listed. For additional information please contact the advisor(s) listed on the site, visit the Cetera Investment Services LLC site at www.ceterainvestmentservices.com

The information on this website is for U.S. residents only and does not constitute an offer to sell or a solicitation of an offer to purchase brokerage services to persons outside of the United States.

Investment Adviser Representatives may only offer advisory services in connection with an appropriate Cetera Advisory Services Agreement and disclosure brochure as provided.

Asset+Map

Using Asset+Map, we can help identify if there are any gaps in funding your retirement or your dreams and run multiple scenarios on the investing options available to bridge any gaps. Asset+Map also allows you to view your finances all in one place with a concise snapshot of where you are today and where you are headed.

Working with an Advisor

Working with an advisor is all about you. The investment process starts with thoughtful dialogue aimed at helping our advisors understand an individual’s needs and goals. These conversations help our local team to tailor products and services specifically for you. Discussions with financial advisors often cover a variety of topics, like the ones below, enabling us to gain deeper insights into your finances as they are today, and what they could be tomorrow.

- Your financial goals

- Current financial position

- Risk tolerance

- Time frame for reaching financial goals

- Investment experience

- Any unique circumstances or concerns

Understanding Your Investment Objectives

You are unique, and how you approach your financial goals should be unique too. With everyone having their own investment personality, it’s important to understand the financial goals that your investments are supporting. Understanding your investment objectives helps define your goals and can help you choose the investment products that may provide the best value to you and your goals. While investing can feel overwhelming, our D.L. Evans Investments team is here to answer your questions, provide solutions, and support you on your financial journey.

Your investment objectives

- What are your most important personal and financial goals?

- How would you like to spend your time in retirement?

- If you have a business, how would you like to participate in or sunset it over time?

Where you are today

- If you currently have a financial plan, how is it invested (savings accounts, money market fund, mutual funds, individual securities, etc.)?

- If you own a business, what is the type, length of ownership, its growth potential, and its liabilities?

- What are your estimated future expenses (college tuition, parental care, long-term care, etc.)?

- What is your projected future income? (inheritance, ssa, retirement)

- Are there any legal considerations our advisors should be aware of, including business, marital, lawsuits, etc.?

Evaluating Your Investments

Reviewing your investment goals, strategies, and portfolio performance is an important part of reaching your goals. As part of an investment review, we will assess your current plan and make adjustments to accommodate new dreams while confirming that your long-term goals are on track.

Investment plan review

- Evaluate planning goals and the progress toward them. Review portfolio performance and determine if you're on track to meeting previously established goals.

- Discuss any rebalancing needs.

- Review asset allocation and selected investments.

- Evaluate allocation rebalancing needs.

- Review the state of the markets and the economy since the last review. Discuss any key events or changes that may affect your plan.

Investment goals, old and new

- Are there any adjustments to your financial goals?

- Do you have questions related to your investment plan, including asset allocation or plan management?

- Are there any questions you'd like to discuss that are related to the market, the economy, specific investments, or asset classes?

- Have you had any changes to your income, expenses, spending needs, or your ability to save or repay debt?

Personal goals, old and new

- Have you experienced family changes such as a birth, death, marriage, or health change?

- Have you received additional income or assets such as an inheritance or bonus?

- Have you paid off any significant loans or eliminated any expenses?

- Have you purchased new financial products such as insurance or investments, or opened new accounts?

Communication

We strive to provide exceptional service and make sure the communication with our clients includes regular planning reviews, check-ins, ongoing education opportunities, and timely market updates. You can also count on a response within 24 hours whenever you contact us with a question or concern. Our commitment lies in providing comprehensive support and prompt assistance to meet your needs effectively.

Fees

Since your financial journey is unique to you, our fee structure is customized to you. We want to provide you with the most value so that we can help meet your investment and planning needs without charging you for services that aren’t relevant to your financial situation. No matter if you want one time only advice toward creating a financial goal, ongoing advice throughout your journey, or assistance with your investment strategies we would love to meet with you.

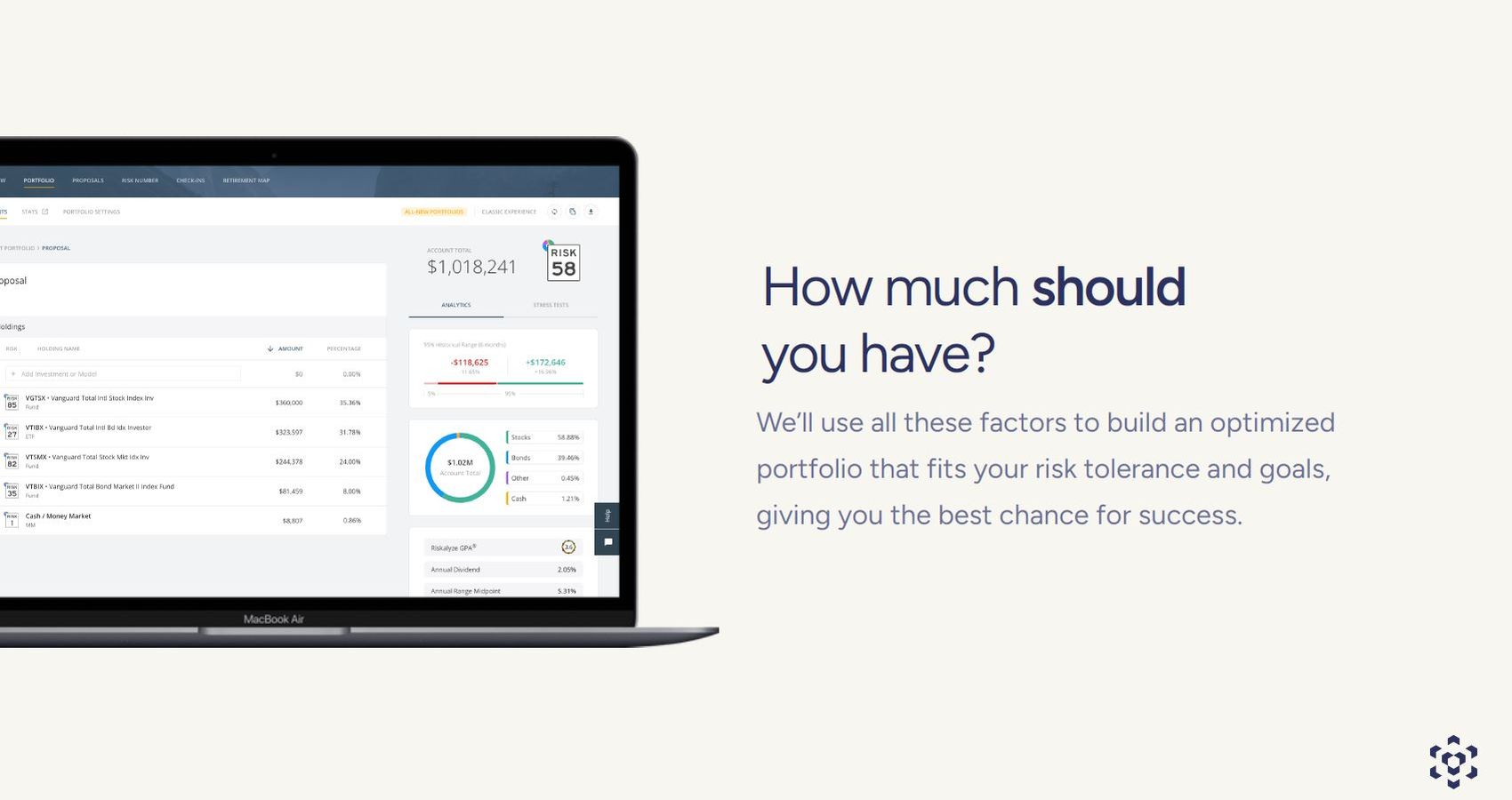

Risk Tolerance Tool

There are many ways our team works to ensure that your investments work uniquely for you, and one of them is determining your risk tolerance. Determining your risk tolerance helps to ensure that the risk for your portfolio of investments matches your comfort level in investing. Why is this important? In a nutshell it leads to peace of mind. Though markets fluctuate, your portfolio can be invested at your comfort level with peace of mind that your investments match your long-term investment goals.